Avalara Taxes 23.1

Avalara Tax Mode Added to Tiers

For companies partnered with Avalara for their tax calculations a Tax Mode option was added on every tier within the Service Order. Having the Tax Mode setting in place on each tier will ensure tax calculations bill in accordance with Avalara’s expectations.

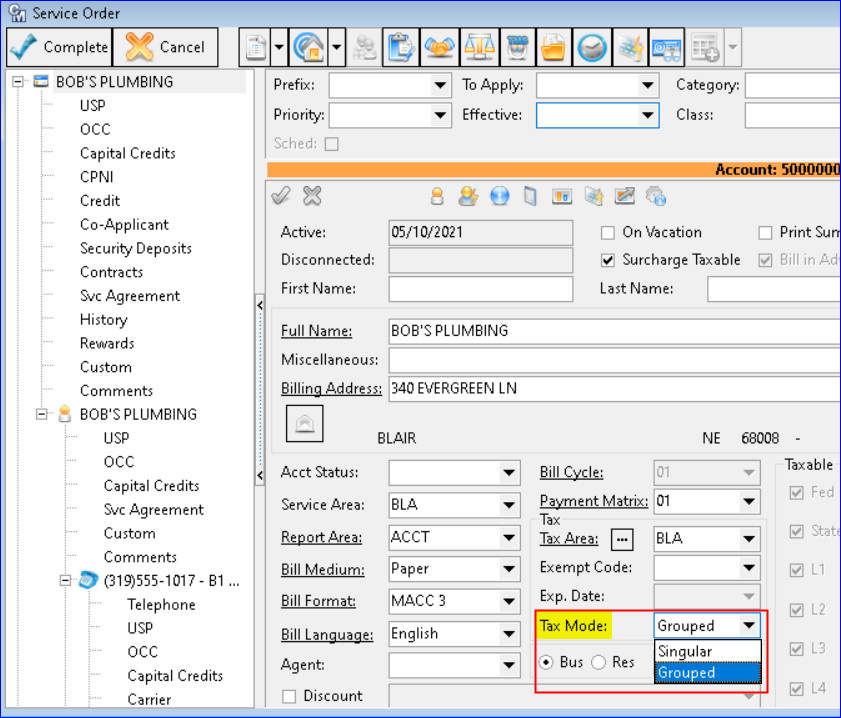

Service Order – Account, Customer, and Network tiers: A “Tax Mode” drop-down box was added in the Tax group box on each tier (Account, Customer, and Network.) Tax Mode is only visible if Avalara is activated in the database. There are two options available for selection from the drop-down.

- Grouped: Indicates the Tax is capped, so after a given line count or sale amount, no additional tax is charged on the amount over the cap. The default is set to Grouped for all tiers

- Singular: Indicates the tax does not apply until the threshold is crossed. After a given line count or sale amount, tax is then charged on the amount above the threshold.

Note: Avalara determines which tiers should be grouped or singular and users should set the option according to Avalara’s direction.

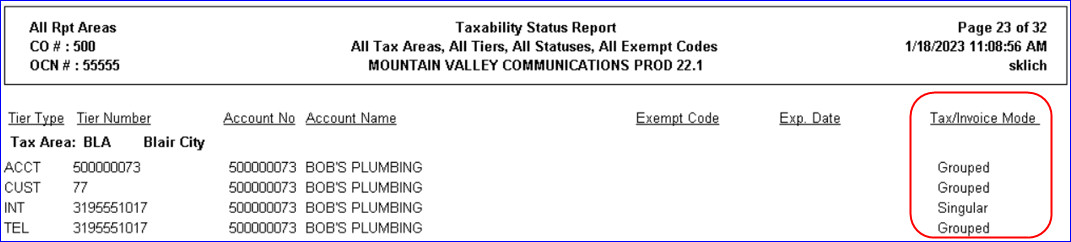

Report Suite | Processing | Reports | Billing | Taxability Status: A column labeled “Tax/Invoice Mode” was added to the Taxability Status report and will display the “Grouped” or “Singular” setting on account, customer, and network tiers. This will only be present when Avalara is activated.

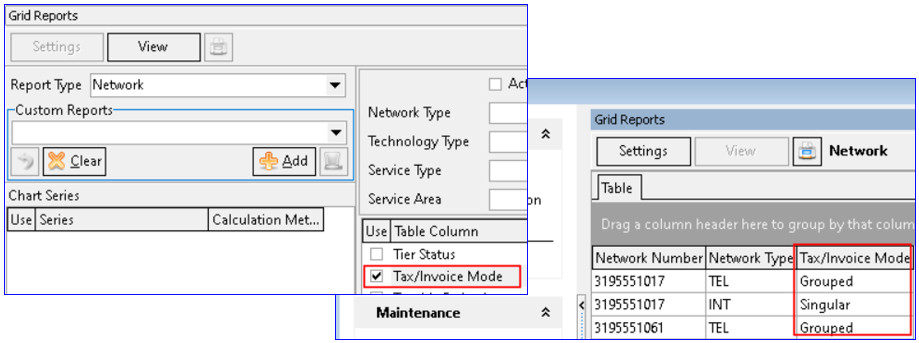

Report Suite | Processing |Grid Reports | Network: A selectable option for “Tax/Invoice Mode” was added to the Grid Report – Network which will display the ‘”Grouped” or “Singular” setting on network tiers. If the option is checked on a database without Avalara enabled the report results will show “N/A” for each row in the column.