Accounts Payable 22.1

Federal Withholding

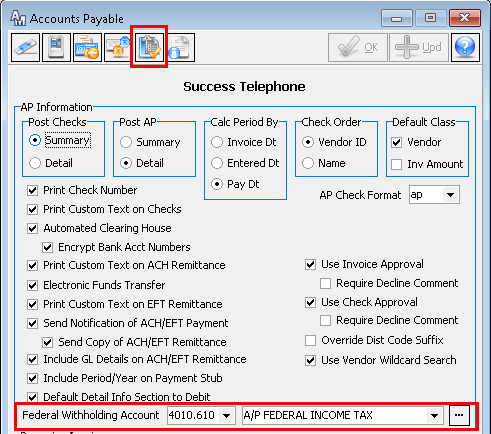

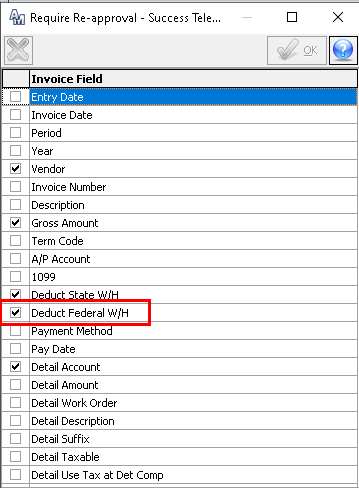

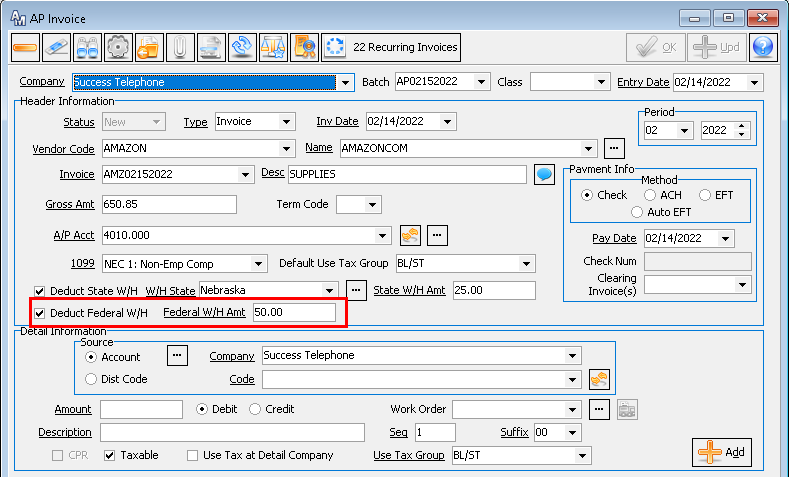

A new option was added to Accounts Payable invoices to Deduct Federal Withholding. To enable this new function, from the Accounts Payable Company table, enter the Federal Withholding Account. When populated, the Federal Withholding GL Account will be used when withholding federal income tax from Vendors during Accounts Payable. In addition, a Deduct Federal W/H option was added in the Require Re-Approval icon.

Improved Attachments

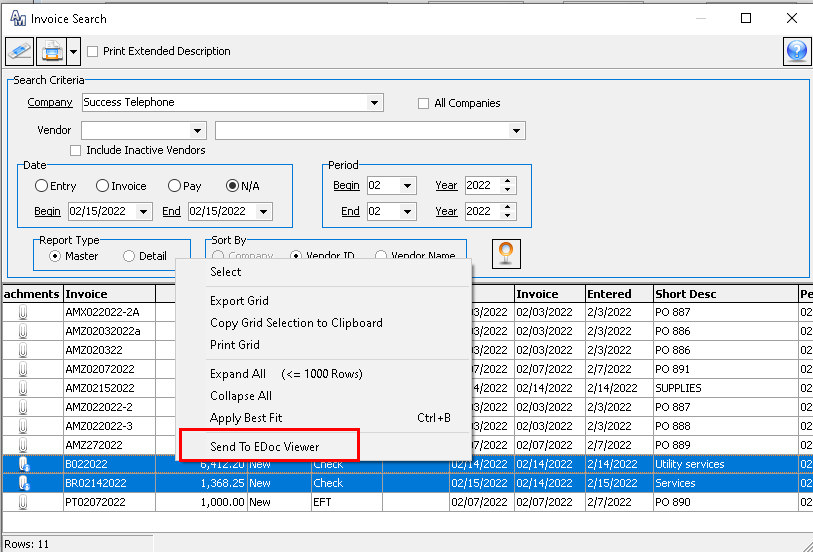

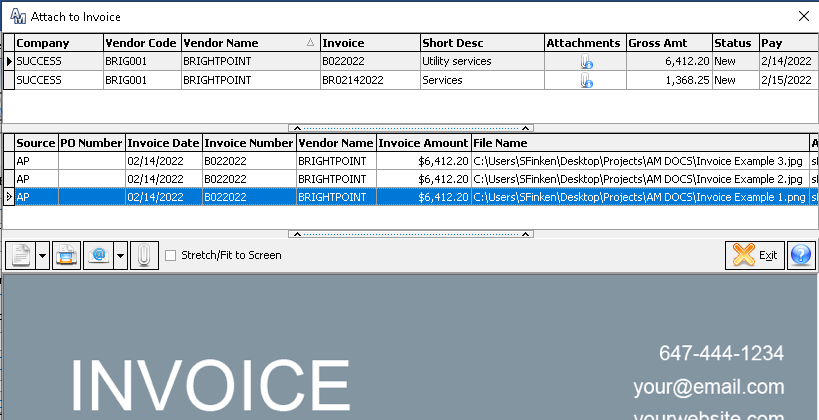

Electronic document storage allows your company to have necessary supporting details at your fingertips. As MACC continues to expand the benefits of document storage, you will now be able to view all associated documents for multiple Accounts Payable invoices. From the Invoice Search screen, users will be able to select multiple invoices with the control and shift keys. To highlight specific invoices, right click in the grid and select the Send to EDoc Viewer option.

This enhancement allows users to view multiple documents without having to open each invoice and attachment separately.

The same option to view multiple invoices and attachments are available during the AP Batch and System Payment Approval processes. This change allows approvers to view multiple invoices and documents during the approving processes.

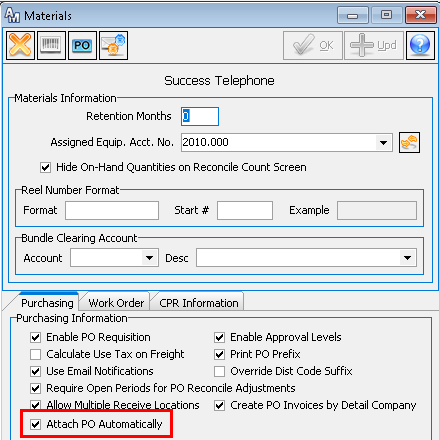

Improvements to Purchase Order attachments were added to promote additional efficiency. A new option, Attach PO Automatically, was added to the Materials Company table. When selected, it will automatically print and attach a Purchase Order to be viewed from AP Invoice as the Purchase Order associated attachment. The document will be named using this format: PO Prefix + PO Number+ Purchase Order + Company ID. For example, a file might be named PO-892-Purchase Order-2. The Purchase Order will be placed in the established Edoc location. When Purchase Order is reprocessed, the system will replace the original copy with the same document name.