Reports for Deduction Contribution Tracking

MACC has taken steps to accommodate the SECURE 2.0 Act, Section 603, catch-up contributions for employees who earned a salary exceeding $145,000 in 2023 which must be treated as Roth contributions. The Employee Deduction report was updated and the creation of the “Deduction Max Contribution Limit Reached Report” provides improved reporting needed for more accurate deduction contribution tracking.

Packages | Payroll | Reports | Processing Reports | Payroll YTD, Deduction, Tax Reports

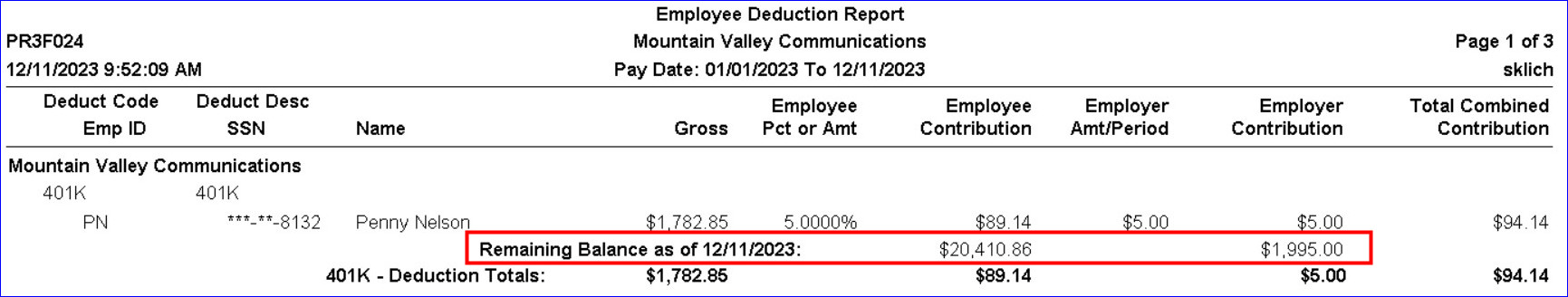

A “Remaining Balance as of xx/xx/xxxx” calculation was added to the “Employee Deduction Report.” The remaining balance total will be displayed in the Employee Contribution column for each employee. If an employee has a maximum contribution amount greater than $0.00, the remaining balance total will be displayed in the “Employer Contribution” column.

Payroll Suite | Processing | Payroll Cycle Processing

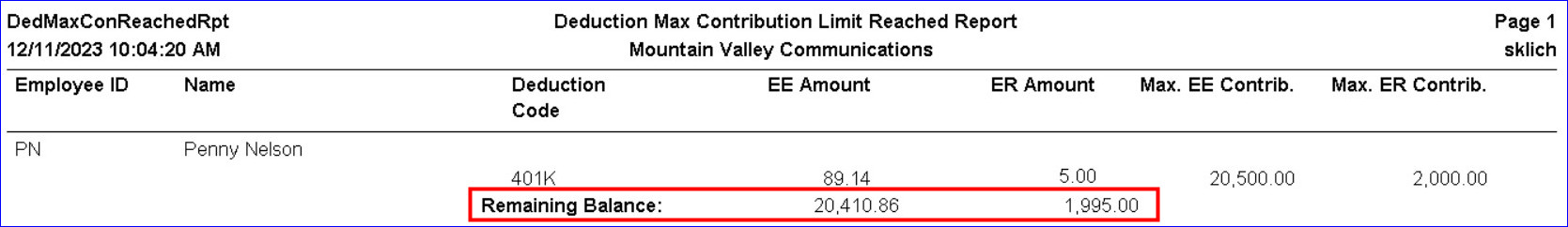

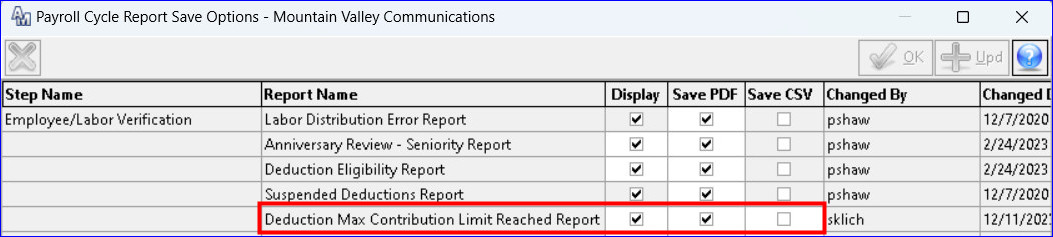

A new report labeled “Deduction Max Contribution Limit Reached Report” was created. The report will appear during the Payroll Process step “Employee/Labor Verification.” The “Deduction Max Contribution Limit Reached Report” was added as an option to the “Payroll Cycle Report Save Options” grid.

When Save PDF or CSV is checked, the remaining balance total will be displayed in the “EE Amount” column for each employee. If an employee has a max contribution amount greater than $0.00, the remaining balance total will be displayed in the “ER Amount” column.